GLOBAL ECONOMY

The inflation rate in the US slowed for the fifth month to 2.50% in August 2024, the lowest since February 2021, from 2.90% in July, and below forecasts of 2.60%. The Consumer Price Index (CPI) increased to 314.80 points in August from 314.54 points in July of 2024, while Producer Price Index (PPI) increased to 0.20% in August 2024, above forecasts of 0.10%, following a downward revision in July that indicated a 0% change.

The United Kingdom’s unemployment rate fell to 4.10% in July 2024, down from 4.20% in the previous month, aligning with market expectations. The number of unemployed individuals decreased by 74,000 to 1.44 million and employed individuals rose by 265,000, reaching 33.23 million. Also, the economic inactivity rate fell by 0.30% points to 21.90% as the British economy expanded 1.20% year-on-year in July 2024, higher than 0.70% in June, but below forecasts of 1.40%.

The European Central Bank (ECB) cut the deposit facility rate by 25bps to 3.50% from 3.75% to ease monetary policy restrictions. Also, the interest rates on the main refinancing operations and the marginal lending facility were lowered to 3.65% and 3.90% respectively starting from September 18th, 2024.

China’s annual inflation rate increased to 0.60% in August 2024 from 0.50% in July, falling short of market forecasts of 0.70%. This is its highest point since February, marking the seventh straight month of consumer inflation amid supply issues due to adverse weather conditions, causing an increase in food prices. China’s trade surplus surged to $91.02billion in August 2024 from $67.81billion in the same period a year earlier, surpassing market expectations of $83.90billion as exports rose much faster than imports.

We await the US Federal Reserve (Fed) Interest Rate decision and Initial Jobless Claims data for the week.

GLOBAL MARKETS

US stocks closed higher this week, ahead of the Fed’s next week meeting as investors processed crucial inflation and labor data. The Nasdaq, S&P 500 and Dow Jones indices all closed positive, increasing by 5.91%, 4.02% and 2.60% to 19,512.23, 5,626.02 and 41,393.78, respectively.

The London’s Financial Times Stock Exchange (FTSE) 100, Germany’s Deutscher Aktien (DAX) and Cotation Assistée en Continu (CAC) 40 in Paris rose by 1.12%, 2.17% and 1.54% to 8,273.09, 18,699.40 and 7,465.25, respectively.

Chinese stocks fell on Friday, as investors reduced holdings ahead of a long holiday. The Hang Seng and Topix Indices also fell by -0.43% and -1.01% to 17,369.09 and 2,571.14, respectively.

We expect the market to trade cautiously, as Investors debate on the probability of a 25bps or 50bps rate cut announcement at the Fed’s Federal Open Market Committee (FOMC) meeting next week.

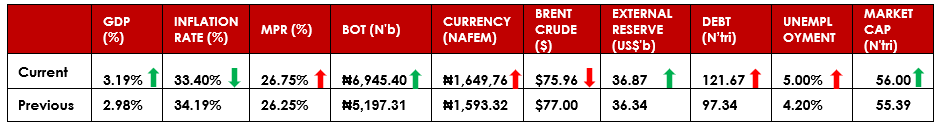

DOMESTIC ECONOMY

The Federal Government on Wednesday announced the raise of over $900million from its $500million 5-year tenor domestic dollar-bond offer that closed last month, August 30 2024. This offer, with a coupon of 9.75%, attracted both retail and institutional investors and resulted in an over-subscription of 180%.

The African Development Bank (AfDB) has announced the launch of a $2billion 5-year social benchmark bond. A social benchmark bond is a type of bond issued specifically to raise funds for social or environmental purposes, such as affordable housing, education, renewable energy, and sustainable infrastructure. The offer’s pricing date was September 10, 2024, while its settlement date is September 18, 2024. The bond’s announcement, which coincided with the 60th anniversary of the AfDB and issued under its sustainable bond framework, is expected to mature on September 18, 2029.

The National Bureau of Statistics (NBS) stated Nigeria recorded a trade surplus of ₦6.94trillion between April and June. The NBS, in its foreign trade report for Q2 2024, said Nigeria’s exports totaled ₦19.42trillion while imports stood at ₦12.47trillion. Total trade was ₦31.89trillion in Q2, a decline of 3.76% compared to the ₦33.14trillion recorded in Q1, 2024.

The NBS also stated that the FGN generated a total of ₦2.47trillion, from Company Income Tax (CIT) in Q2, 2024. The NBS, in its Q2 CIT report, showed a 150.83% increase from ₦984.61billion in Q1 2024. The CIT is a tax on the profits of incorporated entities in Nigeria. It also includes the tax on the profits of non-resident companies operating a business in Nigeria. Local payments received was ₦1.35trillion, while Foreign CIT Payment contributed ₦1.12trillion in Q2 2024.

The NBS is set to release Inflation Data for August on Monday, 16th September, 2024.

DOMESTIC MARKETS

MONEY MARKET AND FIXED INCOME

System liquidity remained negative throughout the week, falling further by -₦226.37billion to close at -₦503.03billion from -₦276.66billion the previous week. Consequently, the Open Repo Rate (OPR) and the Overnight Rate (O/N) remained high, closing at 31.20% and 31.73%, respectively. The Nigerian Treasury Bills (NT-Bills) market average yield decreased by -154bps to 19.64% against 21.18% the previous week.

In the Bonds market, the average benchmark yield for the Short-tenor, Medium-tenor and Long-tenor Bonds decreased by -101bps, -59bps and -45bps to close at 19.08%, 19.09% and 17.55% on a week-on-week basis, respectively.

We expect positive system liquidity next week, due to inflows from FGN Bond coupons.

THE EQUITIES MARKET

Market Capitalization and All-Share Index increased by 1.10% and 1.06% to close at ₦56trillion from ₦55.39trillion and 97,456.62 from 96,433.53 the previous week.

On a sectoral basis, the Banking, Insurance, Consumer Goods, Oil & Gas and Industrial Goods indices all closed higher at 5.12%, 1.59%, 1.47%, 2.00% and 0.17%, respectively.

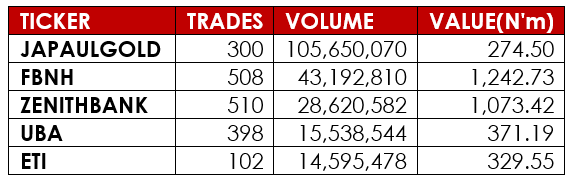

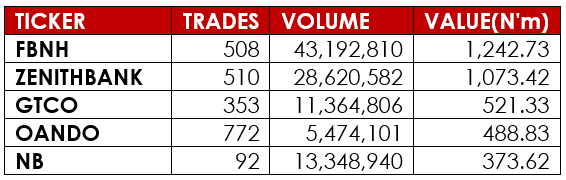

A total turnover of 2.58 billion shares worth ₦51.21 billion in 50,615 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.14 billion shares valued at ₦51.22billion that exchanged hands last week in 55,603 deals.

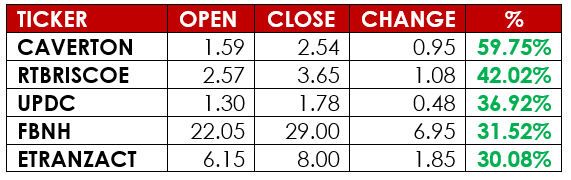

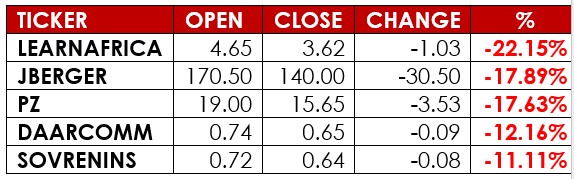

Notable gainers this week were Caverton Offshore Support Grp Plc and RT Briscoe Plc, while notable losers were Learn Africa Plc and Julius Berger Nig. Plc.

We expect Investors’ attention to be tilted towards Banking stocks ahead of Corporate Actions.

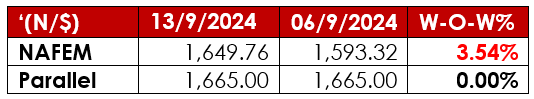

CURRENCY

TOP TRADES BY VOLUME

TOP TRADES BY VALUE

TOP GAINERS

TOP LOSERS

DISCLAIMER

This publication is produced by Alpha10 Group solely for the information of users who are expected to make their own investment decisions without undue reliance on any information or opinions contained herein. The opinions contained in the report should not be interpreted as an offer to sell, or a solicitation of any offer to buy any investment. Alpha10 Group may invest substantially in securities of companies using information contained herein and may also perform or seek to perform investment services for companies mentioned herein. Whilst every care has been taken in preparing this document, no responsibility or liability is accepted by any member of the Group for actions taken as a result of information provided in this publication. Alpha10 Group. 13, Mambolo Street, Zone 2, Wuse, Abuja. Visit us at www.alpha10group.com.

Sources: Yahoo Finance, Trading Economics, Investing.com, Trading View, CBN, NGX, FMDQ, Business Day, The Cable Ng, DMO, NBS, Alpha10 Research