GLOBAL ECONOMY

The US Federal Reserve (Fed) cut the target range for the Fed Interest rate by 50bps to 4.75%-5.00% in September 2024, the first reduction in borrowing costs since March 2020. While the decision to cut rates was anticipated, there were speculations about whether the Central Bank would choose a more conservative 25bps reduction instead. The initial Jobless Claims in the US also dropped by 12,000 from the previous week to 219,000 on the period ending September 14th, significantly below market expectations of 230,000, and reaching a new 4-month low.

The Bank of England kept the Bank Rate unchanged at 5.00% during its September 2024 meeting, following a 25bps cut in August, the first reduction in over four years. This decision met market expectations, though one member voted for a further 0.25% points cut to 4.75%. The annual inflation in the UK was 2.20% in August, the same as in July, and in line with expectations.

The Euro appreciated to €1/$1.12 this week, its strongest level in three weeks, benefiting from a general dollar weakness, after the Federal Reserve lowered interest rates by 50bps. Annual inflation rate in the Eurozone eased to 2.20% in August 2024, the lowest since July 2021, from 2.60% in the previous month and Consumer Price Index CPI In the Euro Area increased to 126.72 points in August from 126.54 points in July, 2024.

China’s 10-year government bond yield rose to around 2.05% after the People’s Bank of China (PBoC) opted to keep its key lending rates unchanged at the September meeting, in line with market expectations. This decision came despite the U.S. Federal Reserve cutting rates. The one-year loan prime rate (LPR), the benchmark for most corporate and household loans, remained at 3.35%, while the five-year rate, a reference for property mortgages, was unchanged at 3.85%.

US Investors await the release of several key economic data next week, as well as speeches from several Federal Reserve officials.

GLOBAL MARKETS

US Stocks closed higher on Friday, following the Federal Reserve’s oversized interest rate cut. The Nasdaq, S&P 500 and Dow Jones indices all closed positive, increasing by 1.43%, 1.36% and 1.62% to 19791.49, 5702.55 and 42063.36, respectively.

European equity markets closed mixed as investors continued to assess the global economic outlook and the latest central bank policy decisions. The London’s Financial Times Stock Exchange (FTSE) 100 fell by 0.52% to close at 8,229.99 while Germany’s Deutscher Aktien (DAX) and Cotation Assistée en Continu (CAC) 40 in Paris rose by 0.11% and 0.47% to 18,720.01 and 7,500.26, respectively.

The Hang Seng and Topix Indices rose by 2.77% and 5.12% to 18,258.57 and 2,642.35, respectively.

We expect the market to trade cautiously, as Investors await the release of crucial US economic data for Q2, 2024.

DOMESTIC ECONOMY

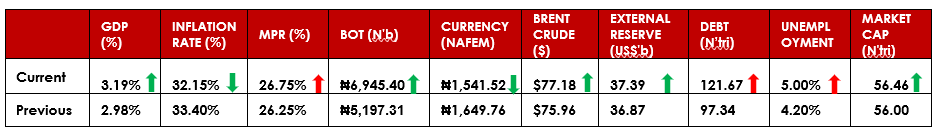

According to the Consumer Price Index (CPI) report published by the National Bureau of Statistics (NBS), Nigeria’s headline inflation rate fell to 32.15% in August 2024 down from the 33.40% recorded in July 2024, reflecting a decrease of 1.25% points. This is the second consecutive monthly slowdown in inflation after easing in the previous month.

The Federal Government, States, and Local Government Councils (LGCs) shared a total of ₦1.20trillion for revenue generated in August 2024 and distributed in September 2024. This represents a decrease of 11.40% compared to the ₦1.36trillion shared from July 2024 revenue, distributed in August.

Nigeria’s public debt is set to rise as the World Bank prepares a $1.70billion loan for Nigeria which will be approved on September 26, 2024. The loan is targeted at improving Nigeria’s healthcare, agriculture, and infrastructure while driving its economic stability and resource mobilization capacity. The World Bank will approve $500million for ‘Nigeria: Primary Healthcare Provision Strengthening Program.’ Another $500million will be granted to Nigeria for a project tagged, ‘Nigeria Human Capital Opportunities for Prosperity and Equity (HOPE) – Governance,’ with a project cost of $700million.

Wale Edun, Minister of Finance and Coordinating Minister of the Economy, says the Federal Government had exited servicing its debts through Ways and Means. Edun spoke on Thursday at the 2024 Access corporate forum, themed, ‘Nigeria’s Economic Rebirth: Hopes and Implications’. His statement comes days after the Central Bank of Nigeria (CBN) said it would sustain its ways and means advances to the federal government at a 5.00% limit for the 2024-2025 fiscal year.

We await the outcome of the Monetary Policy Committee (MPC) meeting, scheduled to hold 23rd and 24th of September, 2024.

DOMESTIC MARKETS

Ecobank Nigeria has successfully secured the approval of its noteholders to amend key provisions tied to its $300 million Senior Note Participation Notes due in 2026, following the severe impact of the Naira’s devaluation on its Capital Adequacy Ratio (CAR).

The approval was announced after a meeting held on September 16, 2024, during which noteholders passed an extraordinary resolution to temporarily suspend Capital Adequacy requirements, providing Ecobank with much-needed financial flexibility.

MONEY MARKET AND FIXED INCOME

System liquidity improved this week, supported by OMO maturities and FGN bond coupon inflows, but however, remained negative throughout the week, to close at -₦272.48billion from -₦503.03billion the previous week. Consequently, the Open Repo Rate (OPR) and the Overnight Rate (O/N) decreased by 151bps and 176bps, closing at 29.69% and 29.97%, respectively. The Nigerian Treasury Bills (NT-Bills) market average yield increased by 27bps to 20.80% against 20.53% the previous week.

In the Bonds market, the average benchmark yield for the Short-tenor increased by 3bps to close at 19.13% while the Medium-tenor and Long-tenor Bonds decreased by -10bps and -3bps to close at 19.14% and 17.49% on a week-on-week basis, respectively.

The FGN is expected to raise ₦150billion and ₦227.54billion in its upcoming Bond and Treasury Bill auctions scheduled to hold on Monday, 23rd September and Wednesday, 25th September, 2024.

We anticipate a cautious trading week, as Investors shift their attention to the upcoming MPC meeting.

THE EQUITIES MARKET

The market opened for four trading days this week as the Federal Government of Nigeria declared Monday September 16, 2024, as Public Holiday to commemorate 2024 Eid el Maulud celebration. Market Capitalization and All-Share Index increased by 0.81% to close at ₦56.46trillion from ₦56trillion and 98,247.99 from 97,456.62 the previous week.

On a sectoral basis, the Banking, Insurance and Oil & Gas indices closed higher at 1.26%, 0.86% and 0.02%, while Consumer Goods and Industrial Goods indices closed lower -0.77, and -0.13%, respectively.

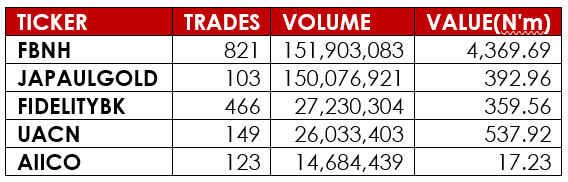

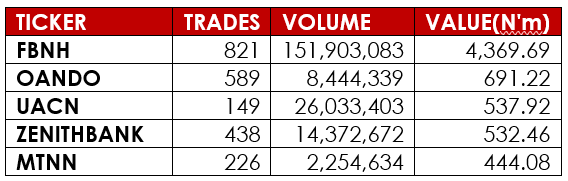

A total turnover of 1.86 billion shares worth ₦38.45billion in 40,228 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.58 billion shares valued at ₦51.21billion that exchanged hands last week in 50,615 deals.

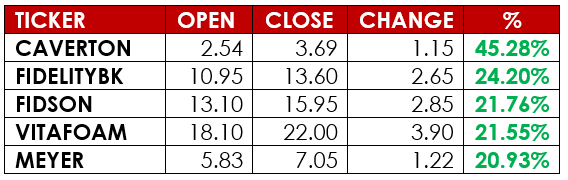

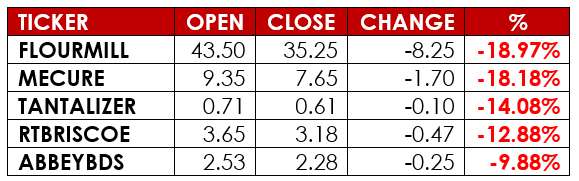

Notable gainers this week were Caverton Offshore Support Grp Plc and Fidelity Bank Plc, while notable losers were Nig. Flour Mills Plc and Mecure Industries Plc.

We expect reduced activity in the Equities market as Investors’ attention tilt towards the upcoming auctions scheduled for next week.

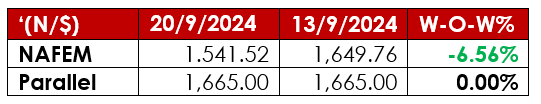

CURRENCY

TOP TRADES BY VOLUME

TOP TRADES BY VALUE

TOP GAINERS

TOP LOSERS

DISCLAIMER

This publication is produced by Alpha10 Group solely for the information of users who are expected to make their own investment decisions without undue reliance on any information or opinions contained herein. The opinions contained in the report should not be interpreted as an offer to sell, or a solicitation of any offer to buy any investment. Alpha10 Group may invest substantially in securities of companies using information contained herein and may also perform or seek to perform investment services for companies mentioned herein. Whilst every care has been taken in preparing this document, no responsibility or liability is accepted by any member of the Group for actions taken as a result of information provided in this publication. Alpha10 Group. 13, Mambolo Street, Zone 2, Wuse, Abuja. Visit us at www.alpha10group.com.

Sources: Yahoo Finance, Trading Economics, Investing.com, Trading View, CBN, NGX, FMDQ, Business Day, The Cable Ng, DMO, NBS, Alpha10 Research