GLOBAL ECONOMY

Donald Trump emerged as the winner of the U.S. presidential election held this week. His victory has introduced significant changes and uncertainties in both the U.S. and global economies. Trump’s agenda which includes imposing steep tariffs, cutting taxes, and deregulating industries, are expected to stimulate short-term economic growth in the U.S. Globally, these policies may disrupt international trade, and create volatility in financial markets as countries adjust to the new economic realities.

The Claims for Unemployment benefits in the US increased by 3,000 from the previous week to 221,000. Despite the slight increase, the figure remained below averages from earlier in the month, indicating some degree of resilience in the US labor market. The four-week-moving average fell by 9,750 to 227,250 as the Federal Reserve (Fed) lowered the interest rate by 25bps to 4.50%-4.75% at its November meeting, following a huge 50bps cut in September.

The Bank of England (BoE) lowered its Bank Rate by 25bps to 4.75% in its November 2024 decision, marking the second rate cut in four years following the start of its cutting cycle in August. The decision was aligned with evidence of slowing inflation in the UK economy, with September’s inflation rate dropping to 1.70%.

The Euro dropped to €1/$1.08, pressured by a stronger dollar and political turmoil in Germany, as concerns rose due to Trump’s victory, over potential economic impacts, including tariffs on major industries like autos and chemicals, as well as security and support for Ukraine. The European Central Bank (ECB) is anticipated to follow suit with a 25bps interest rate cut in December.

China announced an allocation of an additional ¥6trillion to help local governments, which will take effect this year and continue through the end of 2026. The Government also plans to issue ¥800billion annually in special bonds for Local Governments over the next five years to significantly reduce hidden debt from ¥14.30trillion to ¥2.30trillion by 2028.

We await speeches by Federal Reserve officials, as investors seek clues on the Fed’s monetary policy outlook in the light of Donald Trump’s second Presidency.

GLOBAL MARKETS

US stocks continued their upward momentum through the week to close high on Friday, sustained by optimism surrounding Donald Trump’s victory and an interest rate cut from the Federal Reserve. The Nasdaq, S&P 500 and Dow Jones indices closed positive, increasing by 5.43%, 4.66% and 4.61% to 21,121.93, 5,995.54 and 43,988.99, respectively.

European stocks closed lower as Investors weighed earnings reports, recent Central Bank decisions, as the Bank of England cut rates by 25bps on Thursday and the impact that Donald Trump’s economic policies in the US may have in the European corporate sector. The London’s Financial Times Stock Exchange (FTSE) 100, Germany’s Deutscher Aktien (DAX) and Cotation Assistée en Continu (CAC) 40 indices closed negative for the third time in a row, by -1.28%, -0.21% and -0.95% to 8,072.39, 19,215.48 and 7,338.67, respectively.

Asian indices closed higher on Friday compared to the previous week, despite reversed gains from the week as investors cautiously awaited announcements of additional stimulus from Beijing to counteract the impact of higher tariffs under a Donald Trump presidency. The Hang Seng and Topix indices increased by 1.08% and 3.70% to 20,728.19 and 2,742.15, respectively.

We expect mixed trading as Investors await the Consumer and Producer Price Inflation data from the US next week.

DOMESTIC ECONOMY

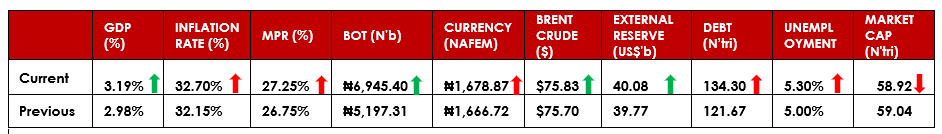

The Federal Government of Nigeria’s fiscal deficit rose to ₦4.53trillion in Q2 2024, up from ₦3.88trillion in Q1 2024, according to the Central Bank of Nigeria’s (CBN) economic report for Q2 2024. The report also stated that despite the Government’s gains from foreign exchange revenue due to naira devaluation, its overall expenditure rose to ₦6.83trillion, driven largely by high-interest payments on loans and other financial obligations.

The CBN report also showed that foreign exchange inflow through the Nigerian economy was $24.55billion in Q2 2024, up from $22.26billion in Q1 2024. This increase was primarily driven by autonomous sources (including remittances, private capital inflows, and other private-sector transactions), as it rose from $14.17billion in Q1 2024 to $16.12billion in Q2 2024. Forex outflows through the Nigerian economy decreased, contributing further to a positive net inflow increase. Total outflows dropped by 31.51%, from $10.77billion in Q1 2024 to $7.37billion in Q2 2024. This resulted in a significant improvement in Nigeria’s net forex inflow position as it rose by 49.39% to reach $17.18billion in Q2 2024, up from $11.50billion in Q1 2024.

The CBN has given Commercial, Merchant, and Non-Interest Banks operating in Nigeria the approval to trade with tradeable foreign currencies deposited in domiciliary accounts created under the foreign currency disclosure, deposit, repatriation, and investment scheme which were not invested immediately. The Bank recently released approved guidelines for the implementation of foreign currency disclosure, deposit, repatriation, and investment scheme, which commenced on November 6, 2024, while stating that the foreign currency deposits being invested by the banks should be made available upon request by participants.

Nigeria’s foreign exchange reserves increased to over $40billion, marking their highest level in almost three years, according to Governor Olayemi Cardoso. He highlighted significant economic improvements under his leadership, stating that the administration’s reforms had started to yield positive results, including marked improvements in the FX market and a stabilization of foreign reserves.

The National Bureau of Statistics (NBS) is set to release the Inflation Report for October on Friday, 15th November 2024.

DOMESTIC MARKETS

MONEY MARKET AND FIXED INCOME

System liquidity opened positive but saw a significant decrease due to OMO settlements and Cash Reserve Ratio deficits despite Remita Inflows into the system. It decreased by ₦923.80billion, from ₦398.31billion to close at -₦525.49billion. Consequently, the Open Repo Rate (ORR) and the Overnight Rate (O/N) increased by 1273bps and 1280bps to close at 31.95% and 32.48%.

The Federal Government raised ₦626.33billion at its Treasury Bills Auction held this week. The initial offer was ₦513.43billion, thus, the auction was oversold by ₦112.90billion. Stop rates closed at 18.00%, 18.50% and 23.00% for the 91-day, 182-day and 364-day bills respectively.

We anticipate mixed trading next week, with investors selectively targeting Bills with attractive yields.

THE EQUITIES MARKET

Market Capitalization and All-Share Index decreased by 0.20% to close at ₦58.92trillion from ₦59.04trillion and 97,236.19 from 97,432.02 the previous week.

On a sectoral basis, the Banking, Insurance, Consumer Goods and Oil & Gas indices closed higher at 4.00%, 0.11%, 0.02% and 5.43%, respectively, while the Industrial Goods index was the sole loser at -0.02%.

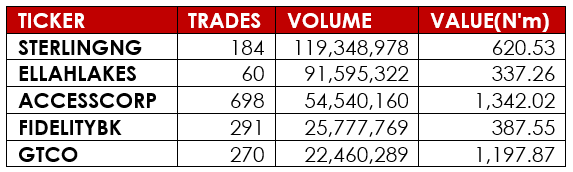

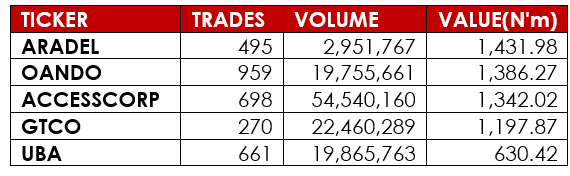

A total turnover of 6.47 billion shares worth ₦75.75billion in 48,804 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.72 billion shares valued at ₦54.63billion that exchanged hands last week in 46,848 deals.

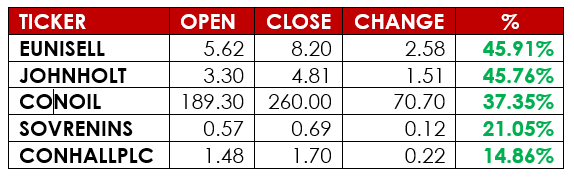

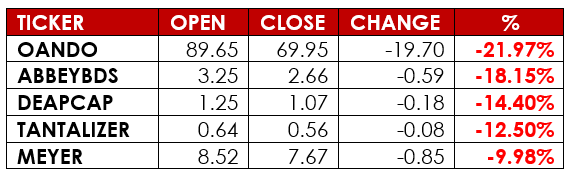

Notable gainers this week were Eunisell Interlinked Plc and John Holt Plc, while notable losers were Oando Plc and Abbey Mortgage Bank Plc.

We expect the Equities market to trade at the same levels next week, with mixed trading on select stocks.

CURRENCY

TOP TRADES BY VOLUME

TOP TRADES BY VALUE

TOP GAINERS

TOP LOSERS

DISCLAIMER

This publication is produced by Alpha10 Group solely for the information of users who are expected to make their own investment decisions without undue reliance on any information or opinions contained herein. The opinions contained in the report should not be interpreted as an offer to sell, or a solicitation of any offer to buy any investment. Alpha10 Group may invest substantially in securities of companies using information contained herein and may also perform or seek to perform investment services for companies mentioned herein. Whilst every care has been taken in preparing this document, no responsibility or liability is accepted by any member of the Group for actions taken as a result of information provided in this publication. Alpha10 Group. 13, Mambolo Street, Zone 2, Wuse, Abuja. Visit us at www.alpha10group.com.

Sources: Trading Economics, Investing.com, CBN, DMO,NGX, Nairametrics, Business Day, Alpha10 Research.